UAE has become one of the leading Middle Eastern countries in the biotechnology and pharmaceutical industry due to its heavy investment and development in the sector. In particular, the Dubai Free Zones and the Dubai Science Park offer opportunities for the establishment of technology-focused companies. To gain a more comprehensive understanding of the benefits and limitations of establishing a legal entity in the UAE, we have compared it to the situation in Czech Republic, Austria, and Slovakia.

Dubai Free Zones

In establishing a legal entity in Dubai, companies can either be established in one of the free zones or as offshore companies. Unlike offshore companies, establishing a company in one of the free zones allows the company to:

- Retain 100% ownership over the company, as opposed to the need for a native UAE “sponsor” typically entitled to 51% of the ownership outside the free zones.

- Be exempt from the corporate, personal, gift, import and export taxes,

- Retain the full profits, and

- Have easy accessibility to labour, legal housing and immigration (Ontdek Dubai, 2022)

The various free zones have proven beneficial to the government as they:

- Incentivize foreign investment

- Increase international trade

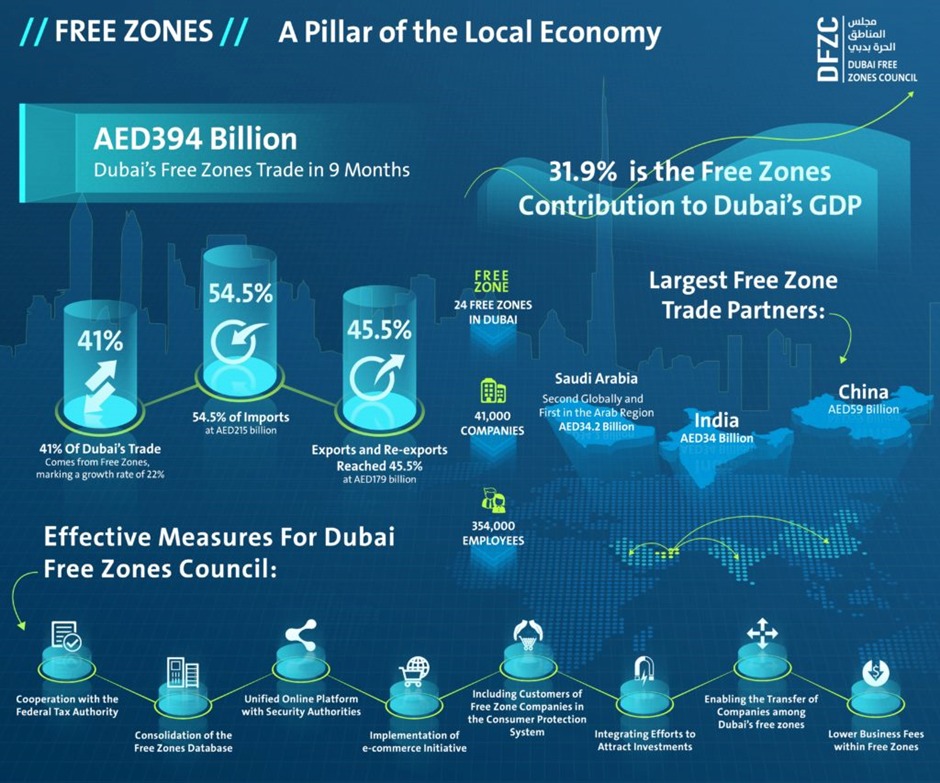

- Contribute to approximately 32% of The United Arab Emirates GDP in 2018 (0ton, 2018)

The free zones are divided according to the different sectors and are geographically close. Below is a figure illustrating the various free zones.

Figure 1: Dubai Free Zones

Dubai Science Park

Originally known as The Dubai Biotechnology and Research Park (DuBiotech), the Dubai Science Park (DSP) was established in 2005 and launched by Sheikh Mohammed bin Rashid Al Maktoum, UAE Vice President and Prime Minister and the Ruler of Dubai. It is home to the companies operating in the biotechnology and pharmaceuticals industry (Bionity, 2022). Internationally renowned companies such as Pharmax’s production facility, US-based Global Biotherapeutics, the Norwegian Jotun Group, the UK-based Ideal Middle East, the US-based BioMedix facilities in in-vitro diagnostics, and The Abu-Dhabi New Medical Center (NMC) (Pharmaceutical Technology, 2022). The Dubai Science Park facilitates the establishment of various start-ups. By 2021, 40% of the companies at DSP were either start-ups or small or medium enterprises (SMEs) (ITP.NET, 2021). This has resulted in an increase in foreign investments, the employment rate, R&D, imports & exports, and expansions and collaborations with foreign investors and governments.

Scope of Dubai Free Zones

Besides the establishment of various international companies and start-ups within the Free Zones, Dubai Free Zone has had a key role in the COVID-19 pandemic. Besides being responsible for the production of the Chinese vaccine Sinopharm, the UAE was also responsible for the distribution of 80% of the World Health Organization’s COVID vaccines (Dubai World Trade Centre, 2021). This was achieved as the UAE adapted quickly and established the Hope Consortium with the aid of Etihad Cargo in the UAE’s largest hub for humanitarian logistics; the International Humanitarian City (Airflight Logistics, 2021). This proves once again the importance, growth, and adaptability of the UAE’s pharmaceutical industry and its medical hubs.

The Czech Republic

Firstly, in the Czech Republic the government has recently taken initiatives to support the emerging biotechnology industry. Those changes, which came into effect in 2022, allow the companies more access to direct financial support for strategic investment actions, given that the investors invest a large sum of money towards the equipment used for R&D purposes and that they create 250 new employment opportunities. Additionally, investment-to-cost ratio is set at 10% and capped at EUR 60M in all regions except for Karlovy Vary, Ústí nad Labem or Moravian-Silesian regions where the investment-to-cost ratio increases to 20%. While the new initiatives significantly help and facilitate new investments in the industry, the free zones in the UAE have a full exemption from taxes and no conditionalities for setting up a legal entity.

Austria

Similarly to the UAE, Austria’s life sciences industry constitutes a large percentage of its GDP (6%) and thus the government is invested in nurturing the business. As part of the Austrian government’s life sciences strategy, there are significant tax reductions on 14% of the R&D expenditures, corporate, as well as on individual taxes. It also established Vienna BioCenter which provides access to infrastructure and co-working spaces for bio-med research. Furthermore, it reduced the bureaucracy and supports intellectual property rights for innovative drugs. In both, UAE and Austria, a large portion of the companies are start-ups or SMEs however also many renowned international biotechnology companies have branches in both countries. However, while the success of the UAE free zones is limited by the inadequate workforce and the gap in the education and research, Austria’s industry flourishes for the availability of those prerequisites. Many Austrian universities are active in high-end R&D topics which contributes to the well-educated workforce. Thus in Austria majority of the workers are nationals.

Slovakia

The Dubai Free Zones are designed to attract foreign investment and facilitate international trade, while the science parks and research centres in Slovakia primarily serve the local market. The Dubai Free Zones offer a range of tax incentives, customs exemptions, and other benefits to businesses, while the science parks in Slovakia focus more on collaboration between academic and business communities to drive innovation. The DSP, on the other hand, is specifically designed to foster scientific research and innovation.

The science parks and research centres in Slovakia and the Dubai Free Zones and Dubai Science Park (DSP) serve similar purposes in promoting innovation, research, and development, but there are some differences in their focus and structure. In terms of infrastructure and resources, the Dubai Free Zones and DSP have access to cutting-edge technologies, world-class facilities, and a highly skilled workforce. Slovakia's science parks and research centres, while also providing excellent facilities and a talented workforce, may not have access to the same level of resources as Dubai due to the differences in their economies and levels of investment. As mentioned, one of the main challenges faced by the Dubai Free Zones is the relatively small pool of qualified local talent. Due to historical reasons, the UAE has relied heavily on foreign workers to fill many of its professional and technical roles. While the government has made significant efforts to develop the local workforce through education and training programs, there is still a shortage of qualified candidates. In contrast, Slovakia has a well-educated and highly skilled local workforce, particularly in the fields of science and technology.

The country has a long tradition of providing high-quality education in these areas, and its universities and research centres are known for producing talented graduates. In summary, while both the UAE and Slovakia have active life sciences, biotech, and pharmaceutical industries, they differ in terms of their market size, investment and funding, regulatory environment, talent pool, and manufacturing capacity. These differences can impact the growth and development of these industries in each country.

Limitations of the Dubai Free Zones

While the free zones have proven successful for the national and international economy, as well as for the biotechnology industry as a whole, it is still worth mentioning their limitations. Firstly, while the Free Zones have encouraged investments and the growth of the biotechnology market, there is not many opportunities for education on the field. Thus, the UAE is left with the large job market in the industry, however, with the lack of personnel who have the knowledge and skills. To build up on that, the majority of the companies in the free zones are international, thus there is not much progress on the national level. Lastly, since local employees with the necessary expertise in the field are scarce, most employees have international background. This means that the companies may be often faced with high costs for the sponsorship of said employees, and in many cases, their families as well.

Authors: Rahma Seliem, Anna Macko

For more info on how to establish your own biotech operation in Central Europe, reach out to info@ambiom.com.

Sources:

- https://www.moec.gov.ae/en/free-zones?category=229817

- https://www.thenationalnews.com/business/economy/dubai-free-zones-saw-22-trade-growth-this-year-government-says-1.805246#:~:text=Overall%2C%20the%20free%20zones%20generated,the%20Dubai%20Free%20Zones%20Council

- https://www.bionity.com/en/encyclopedia/Dubiotech.html

- https://www.pharmaceutical-technology.com/projects/dubiotech/

- https://www.itp.net/emergent-tech/digital-transformation-has-opened-new-opportunities-to-enter-the-health-sector-and-we-are-here-to-assist-them-every-step-of-the-way-says-md-janahi

- https://www.dwtc.com/en/industry-insights/how-covid-19-is-reshaping-dubais-pharma-industry/

- https://u.ae/en/information-and-services/justice-safety-and-the-law/handling-the-covid-19-outbreak/distributing-covid-19-vaccines-globally

- https://www.s-ge.com/en/article/global-opportunities/20194-c5-austria-life-science

- https://www.noerr.com/en/newsroom/news/czech-republic-new-investment-incentives-rules-aim-to-support-technological-start-ups

- https://portal.mhsr.sk/files/esluzby/COO/sario-pharmaceutical-and-life-sciences-sector-in-slovakia-2019-07-09.pdf

No comments.